》View SMM Silicon Product Prices

》Subscribe to View Historical Price Trends of SMM Metal Spot

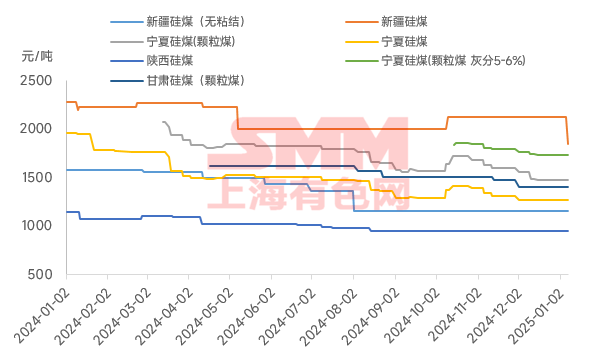

Entering January, under the influence of insufficient stockpiling enthusiasm from downstream end-users before the Chinese New Year and the continued weak price trend, the January silicon metal market performed poorly. Additionally, overall operating rates are expected to decline further. The dual impact of low operating rates and limited year-end raw material stockpiling plans by silicon enterprises has further impacted the silicon coal market, leading to another price drop recently.

This price reduction mainly affected Xinjiang silicon coal, which had been fluctuating at highs. Due to the prolonged high prices of Xinjiang silicon coal and the impact of multiple price reductions in other regions' silicon coal throughout 2024, despite the high quality and limited supply of Xinjiang silicon coal, the high price spread, combined with the resistance from downstream silicon metal markets, led to a decision to adjust prices downward at the beginning of 2025.

Currently, silicon coal prices in other regions remain stable at low levels. Before the Chinese New Year, the stockpiling enthusiasm of silicon enterprises is low. Coupled with the expectation of maintenance and furnace shutdowns in some small silicon metal plants in January, the overall operating rate of downstream silicon metal may continue to decline slightly. Meanwhile, coking coal prices have also dropped again recently, weakening the cost-side price support for silicon coal.

In summary, under the dual weakness of demand and cost, silicon coal prices are more likely to fall than rise. However, considering that current silicon coal prices have already dropped to near multi-year lows, the downside room for further price declines may be relatively small. In the short term, the probability of a rebound in downstream silicon metal markets remains low, and the overall operating rate in the industry is expected to remain relatively low. Overall, the probability of weak price performance in the silicon coal market remains high.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)